income tax plus self employment tax

It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. Ad Get Tips on Managing Your Taxes If Youre Recently Self-Employed.

Problem 6 16 Self Employment Tax Lo 6 6 Stewart Chegg Com

Get a personalized recommendation tailored to your state and industry.

. Generally the amount subject to self-employment tax is 9235. Self-employment income is income that arises from the performance of personal services but which cannot be classified as wages because an employer-employee. Your net earnings from self-employment were 400 or more.

You usually must pay self-employment tax if you had net earnings from self-employment of 400 or more. Ad See What Youve Been Missing. All your combined wages tips and net earnings in the current year.

Adjusted Gross Income AGI is your net income minus above the line deductions. Generally it applies to self-employment earnings of 400 or more. Use QuickBooks Self-Employed To Help You Get Your Business Up And Running.

Small business owners contractors freelancers gig workers and others whose net profit is greater than 400 are required to pay self-employment tax. Your employment wages and tips should have a 62 deduction. Individuals pay this tax using form 1040 es.

As a general rule multi-member LLCs are taxed as partnerships with all income and deduction items flowing through and taxed to the individual members income tax filings. The tool automatically calculates the self-employment tax and the self-employment tax deduction and incorporates these into its overall tax liability estimate. The IRS lets you deduct 765 percent because thats what you would get to deduct if.

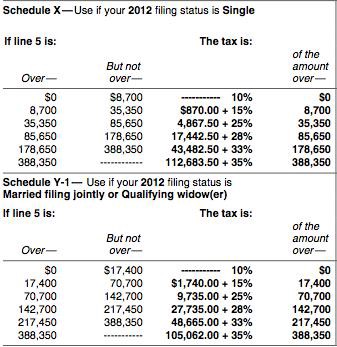

SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. Track Expenses Automatically Maximize Deductions. The self-employment tax is 153 which is 124 for Social Security and 29 for Medicare.

Discover Helpful Information and Resources on Taxes From AARP. The amount increased to 147000 for 2022. Figure out your net earnings subject to self-employment tax.

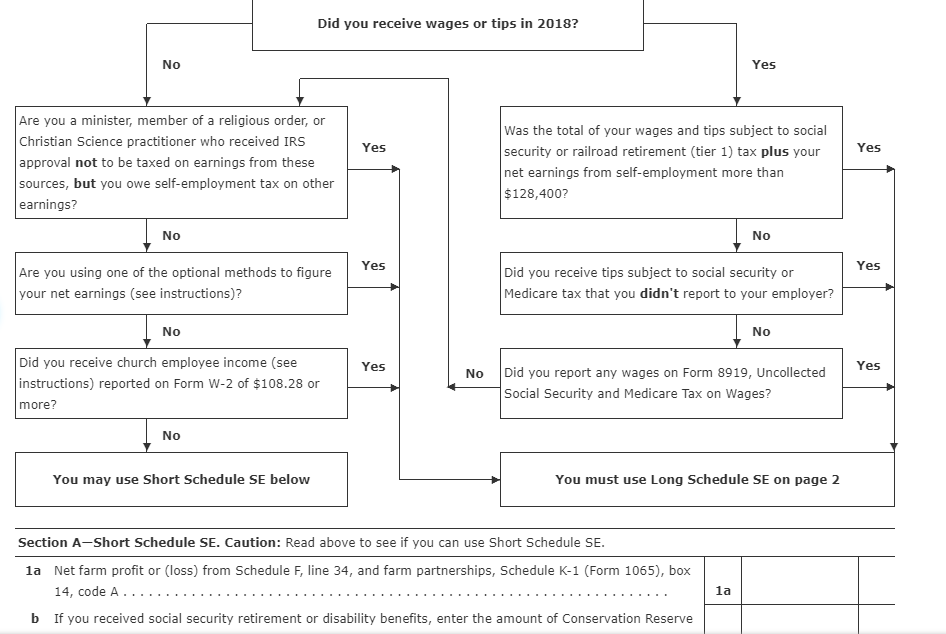

The calculator took one of these for you known as the self employment deduction. Ad Access Tax Forms. However if you are self-employed operate a farm or are a church employee.

For 2022 2022 quarterly estimated tax deadlines are as follows. Get a personalized recommendation tailored to your state and industry. The Social Security portion of the tax is paid on the first 147000 of employment income in 2022.

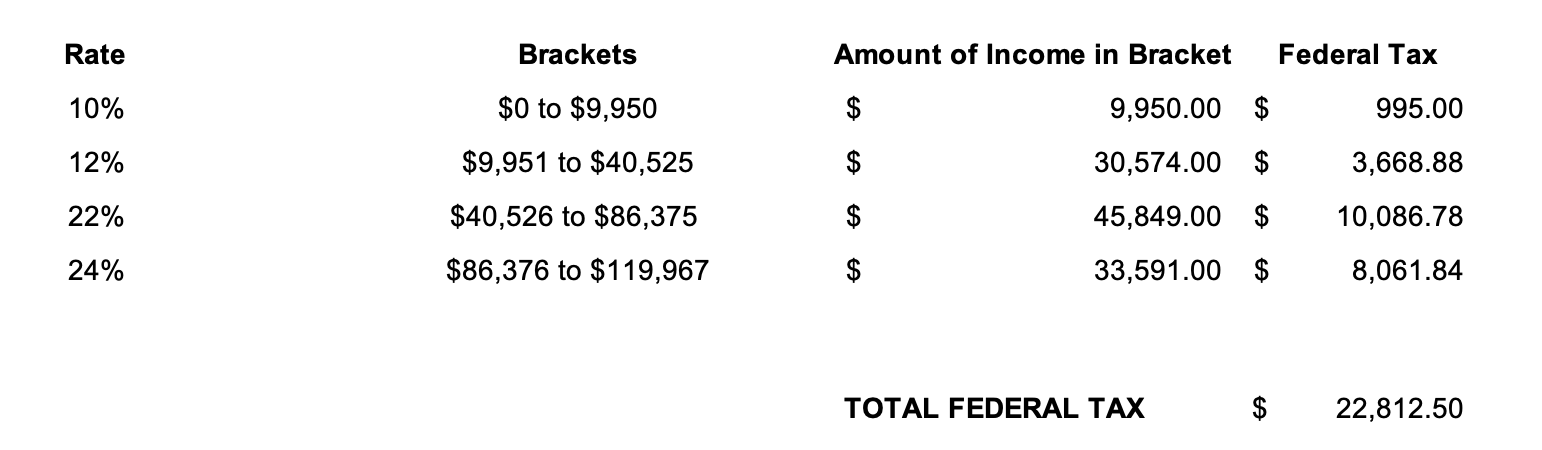

If you only file that you will pay around a 30 tax rate on 70000. Who Needs to Pay. Complete Edit or Print Tax Forms Instantly.

Self-employed workers are taxed at. Unfortunately when you are self-employed you pay both portions of these. For SE tax rates for a prior year refer to the Schedule SE for that year.

100000 x 9235 92350. Normally these taxes are withheld by your employer. Income Tax Plus Self Employment Tax.

Use this calculator to estimate your self-employment taxes. Next multiply your self-employment taxable. However if you find that after mileage deductions tools supplies van repairs insurance retirement savings.

As a rule you need to pay self-employment tax if your net earnings from self-employment are at least 400 over the tax. Ad Our clients typically receive refunds 7061 greater than the national average. Download Or Email CR-Q2 More Fillable Forms Register and Subscribe Now.

Calculate your self-employment taxes. You generally only pay self-employment tax on 9235 percent of your taxable profits. In 2021 income up to 142800 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA.

Ad Our clients typically receive refunds 7061 greater than the national average. You must pay SE tax and file IRS Form 1040 Schedule SE Self-Employment Tax if either of the following applies.

Self Employment Tax What Is The Self Employment Tax In 2019

What Are Employer Taxes And Employee Taxes Gusto

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Payroll Taxes Who Pays How Much And How If Self Employed Don T Mess With Taxes

How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Self Employment Tax Everything You Need To Know Smartasset

Independent Contractor Taxes What Employers Need To Know Adp

Business Tax Quick Guide Tax Year 2020 Journal Of Accountancy

Most Overlooked Tax Deductions And Credits For The Self Employed Kiplinger

Here S A Surefire Tax Estimating Process For Freelancers The Billfold

Self Employment Tax Tax Guide 1040 Com File Your Taxes Online

Free Llc Tax Calculator How To File Llc Taxes Embroker

How An S Corp Could Save You 5 000 Or More On Your Freelance Taxes Collective Hub